Stripe is a private technology company in the field of supplying the means of Payment processing amongst Companies, based in San Francisco, California since 2011. Its services reach to all corners of the globe and led by the original founders & Entrepreneurs Patrick & John Collison.

Their mission to increase the Gross Domestic Product (GDP) of the Internet says everything about them. Their passion for building economic infrastructures for the internet for all sizes of businesses from Startups to fully Public Companies with their easy to install and use software which can accept payments and manage their activities online.

The is services, managed by a 1000 plus network of hard-working individuals who pay particular attention to the service of Payments, Subscriptions, Connections, Relaying, and Fraud Protection.

Stripes Product & Service Range

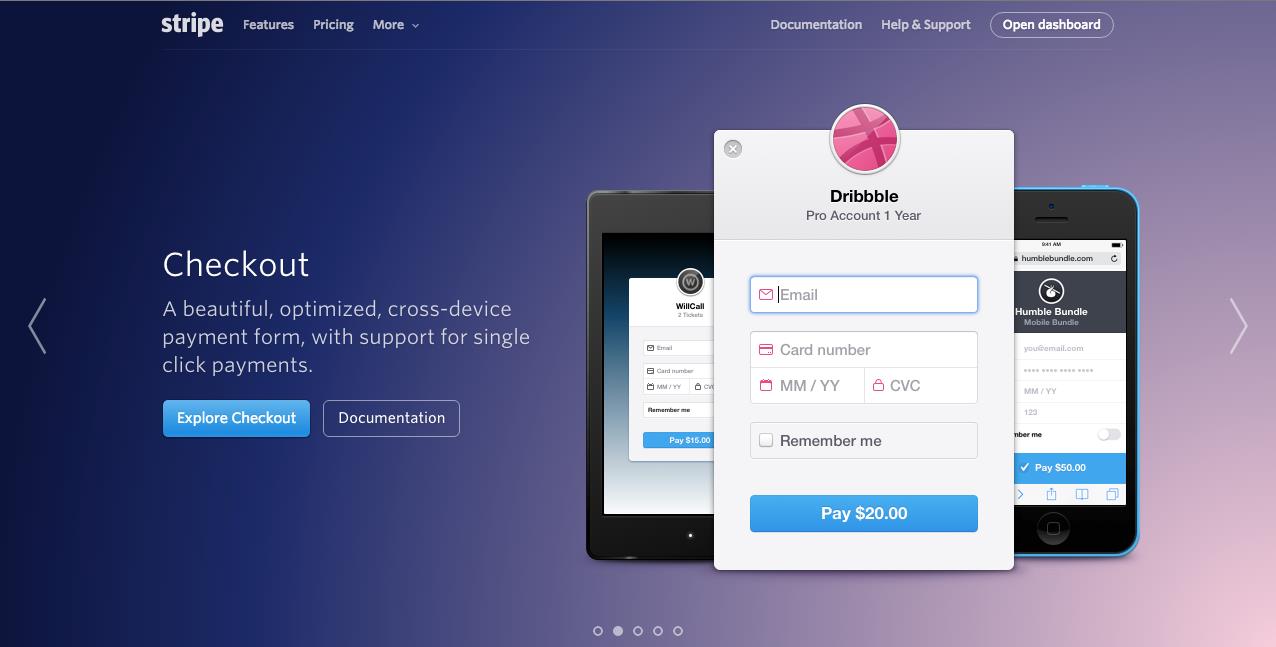

By providing an Application Programming Interface (API), Stripe enables WEB Developers/Designers to integrate payment processing into their Web sites & Mobile Applications. This year, in April Stripe, introduced an ANTI FRAUD tool that runs alongside the payments APIs that blocks any fraudulent transactions.

Stripes have not rested their laurels and now have ventured into The Cloud with their Two-year-old platform named RECEPTION.

In a very short span of time Stripes has become one of the leading Payment Service Providers and ranked up alongside the likes of Apple Pay, Amazon Pay and PayPal.

In the UK, Payment Service Providers are companies such as Creditcall, IP Payments, eWAY, OFX, PAYPOINT, Square, TransferWise and Stripe.

What is a Payment Gateway?

This is a Merchant Service that is provided by any e-commerce Application Service Provider such as a Bank or Building Society than authorises Credit card & Debit Card payments for e-businesses, online Retailers, and companies with little to no Internet presence.

Stripe is a “White Label Payment Gateway”. In other words, their services are allowed to be fully branded and In-House from start to finish, bringing all payments through their highly secured processes to prevent fraud at any level.

One question now comes up every day in our workplace: Who should we choose Stripe or PayPal?

Stripe is the new boy on the block, and PayPal seems like they have been in our lives since the beginning of time. PayPal is a trusted brand with a long history of processing our payments on the great Wide Web.

To help find your answer on the difference between these two giants of Payment Processing you need to look at five essential elements:

Transaction & Service Fees - Currently, Stripe charges a flat rate of 2.9% + 30p per successful charge, as long as you are trading below $1 million in volume Annually. Paypal is the same with an added extra services fee.

Security - Both Stripe & PayPal are very secure and stable platforms to work with.

API - Both companies again through the competition between them, offer a clean, well documented and straightforward to use payment processing methods from start to finish.

Data Portability - Stripe wins here due to their ethos of allowing its customers to move to other companies if they so wish without restriction. PayPal does not allow this and never has.

Customer Service - Again Stripe rules the day, mainly because they are the new boys on the block versus PayPal who to be fair to them is suffering from age, scale and of course pure bureaucracy.

For more in-depth information, please click here: PayPal versus Stripe

Benefits of having the Stripe APIs integrated into your business online

Stripe is first and foremost a software platform directed to online Business with over 100,000 businesses spread over 100 countries, including such well-known companies as Facebook, Expedia, Amazon, Nasdaq, Shopify and many more.

They handle billions of Euros on a yearly basis which allows full support for all kinds of business models Globally.

Stripes Tools are developed to the highest standards to allow complete flexibility for e-commerce. Their APIs assist all users with their subscription service, their position in the global marketplace, and the establishment of an e-commerce presence.

Stripes also offer a Micro Financing Platform too, that is scalable as you grow and allowing the levels of security not to fall.

Stripes are a dedicated company towards innovation, so all of their clients have access to all the latest technological breakthroughs as they happen. Companies that did not exist ten years ago are now becoming household names.

Stripes offer a complete payment platform that is designed with growth in your business at the forefront. Whether you wish to invoice your clients periodically or wish to create a marketplace or merely accept payments Stripes have the solutions ready to do whatever you need.

Are you going to trade internationally? Stripe will ensure your income is converted from currency to currency during the purchase process that will enable full optimisation rates without the need for the owner to do anything.